Rings of Power Viewing ✔

Just finished watching The Lord of the Rings: The Rings of Power, and I must say it was a good series although I did finish it quickly. I enjoyed the show's high production values, character development, and faithfulness to the source material. Really looking for ward to the next season.

Yield Compounding Dynamics

The prevailing market structure currently brings me to set yield-generating to automatic compounding. However, it is crucial to note that $SURGE is an exception, setting to $HBD. This deviation warrants careful consideration regarding the project's economic model and long-term sustainability compared to its peers with compounded yields.

2025 is closing

Although the $HIVE token is trading below 9 cents, it has generated $58,781.67 in revenue, a 357% increase over full-year 2024 projections. This growth, with less than 2% of the year remaining.

Yesterday's volume

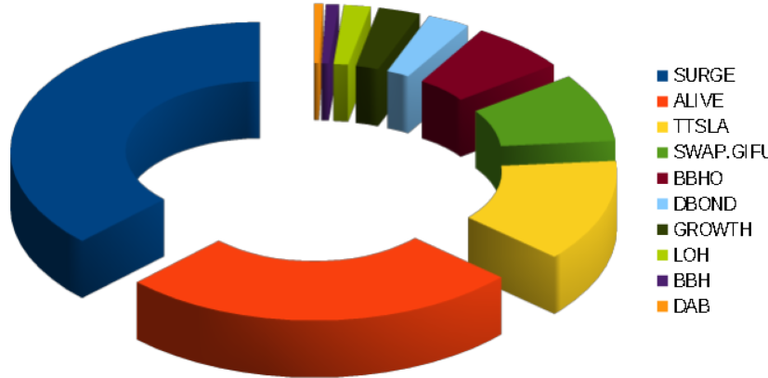

Yesterday's top 10 by volume were dominated by a mix of established players and newer entrants in the digital asset market. At the top of the list, SURGE led the pack, ALIVE was a close second, with over $40 million in trades, suggesting significant buying pressure from retail or institutional investors alike.

The remaining assets on the list, including TTSLA, GIFU, BBHO, and DBOND, represented established players in their respective markets, while GROWTH, LOH, and BBH were newcomers to the top 10 by volume.

$HIVE Price Continues Descent

Observing the ongoing price action of the $HIVE token, it is evident that its value has continued its downward trajectory, currently hovering below 9 cents. This persistent decline suggests challenges related to supply and demand dynamics or broader market sentiment affecting the token. While token prices can fluctuate significantly in the crypto space, a sustained trend below this level requires deeper analysis into adoption rates, utility, and competition to assess if this is a temporary correction or an emerging long-term pattern.