I came across a rather useful tool today - the "Buffett Indicator" - but before I dive into that, bear with me as I backtrack a bit...

Is Bitcoin's 4 Year Cycle Still a Thing?

A couple of months ago the guys who run the @liotes project asked us to predict where we thought HIVE would be in a year's time (May 2026) on a scale of 0-100 with 50 being "the same valuation as now." I gave it a score of 68 and explained why in the comments. Check out the original post here:

https://hive.blog/tribes/@liotes/hive-barometer

In other words, two months ago, I was predicting a moderate appreciation in the value of Hive against the US dollar. However, I was struck by a bearish comment by @mypathtofire who wrote:

I give Hive 40. It has some staying power, but we don't know what the bear market will be like next year.

I asked @mypathtofire to clarify his comment and he pointed out that we are currently in the third year of the "four year cycle" of Bitcoin and that the fourth year is typically a bearish year for Bitcoin, which causes alt coins to decline in value too.

Of course, the debate right now is around whether or not Bitcoin has broken out of the four year cycle and my guess was that it probably had, or at least, my expectation was that Bitcoin would continue to rack up new all time highs deep into 2026, accompanied by bouts of volatility...

However, @mypathtofire his comments gave me pause for thought, in spite of my long-term bullish outlook for Bitcoin...

Then, today, I came across the "Buffett Indicator" while watching a Youtube video during a ten-minute workout - and it also gave me pause for thought...

What Is The Buffett Indicator?

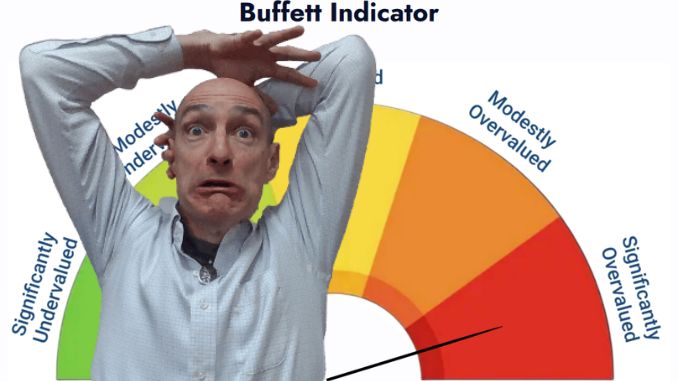

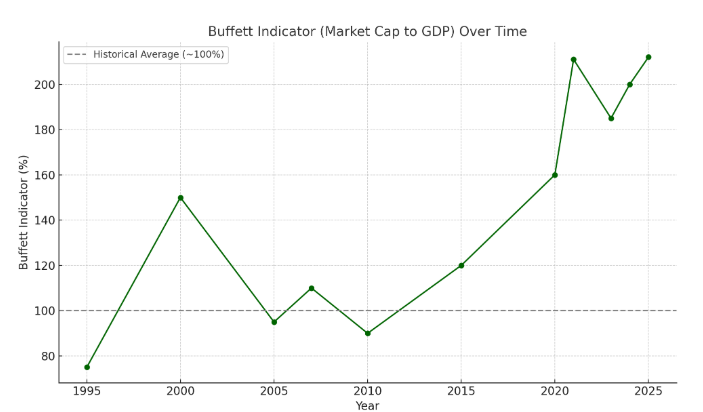

The Buffett Indicator is a way to measure whether the stock market is overvalued or undervalued. According to Wikipedia it was,

"proposed as a metric by investor Warren Buffett in 2001, who called it "probably the best single measure of where valuations stand at any given moment"

It compares the total value of all publicly traded companies (market capitalization) to a country’s total economic output (GDP). If the stock market’s value is much higher than the GDP, it may suggest that stocks are overpriced and a correction could happen. If it's lower, it might mean stocks are undervalued.

In other words, if the indicator is above 100%, the market could be overvalued; if it's below 100%, the market may be undervalued.

Of course, it’s not a perfect tool because it doesn’t look at interest rates, global markets, company profits, political factors or "black swan" events, but since valuation is a key metric, it is well worth keeping an eye on.

What is the Current Situation?

Right now the Buffett Indicator is signalling a record level of market overvaluation, back up and pushing beyond the overvaluation of the 2021 Covid stimulus bubble, and well above the levels of the 2008 crash.

The best analysis that I have found, which includes a section outlining criticisms of the indicator model is here:

The Fear/Greed Index

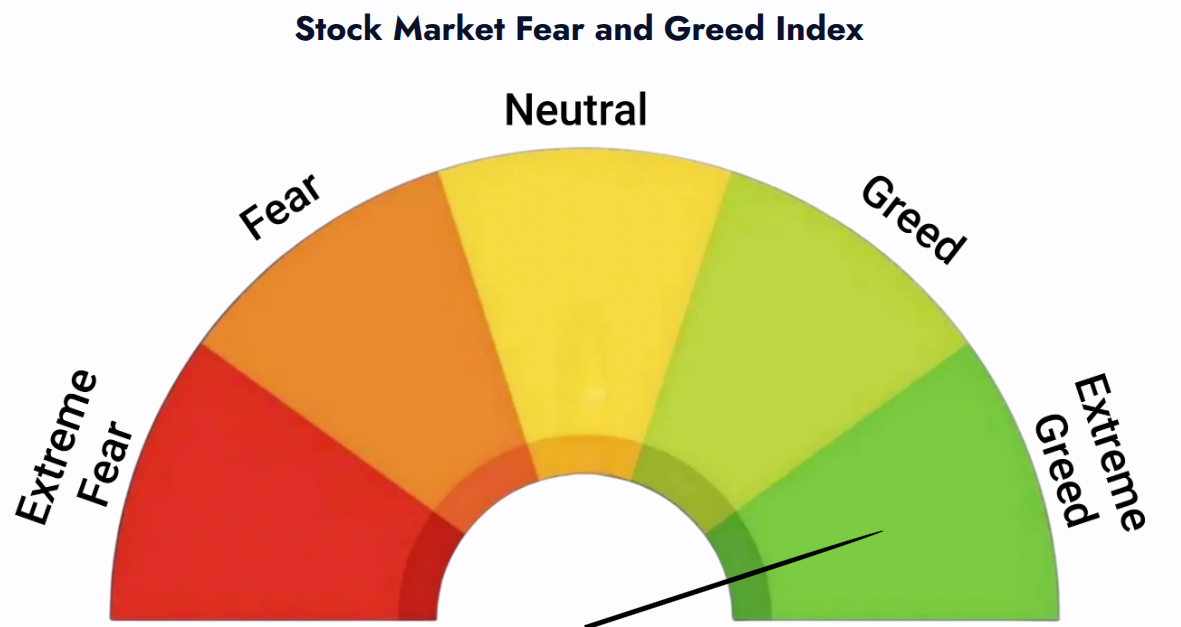

You'll probably be familiar with one of the most famous dictums of the Sage of Omaha:

Be fearful when others are greedy. Be greedy when others are fearful.

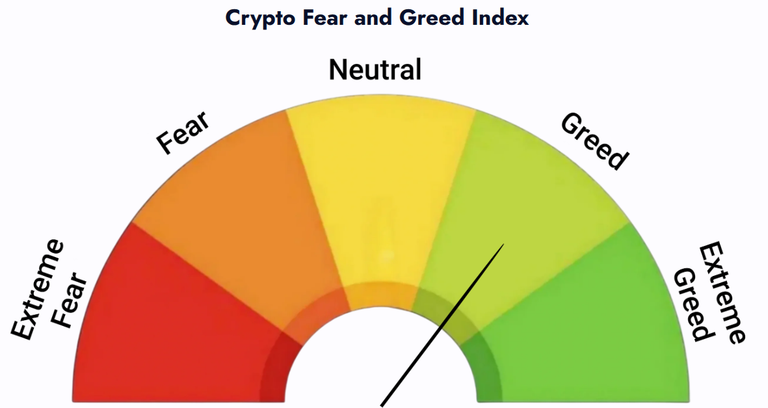

To help us achieve that, there is another metric indicator on the BuffettIndicator website, the "Fear and Greed Index." It measures the "fear/greed" sentiment in relation to the US stock market, and the "fear/greed" sentiment in relation to "Bitcoin and major altcoins" - so not HIVE then!

Here's the state of play with US stocks right now:

And here's how things stand with the crypto markets right now:

Ho ho, we are only in the "greed" stage for crypto! Maybe there's some more upside to be enjoyed...!

Source: https://feargreedindex.net/#crypto-fgi

What Does This Mean for Hive?

The short answer is, "I don't know." However, I will offer here the reasoning behind my moderately bullish prediction for the price of HIVE in May 2026, which was:

If you look at this Hive chart https://www.coingecko.com/en/coins/hive and set it to max you see that Hive hasn't dropped into single figures - the lowest I could find was back in April 2020 when it briefly dropped to about $0.103. Today [May 2025] it's around $0.255 and the lowest it's dropped in the last year is about $0.16. I think there is more upside than downside potential, and if Bitcoin goes on a charge Hive could well rise on the updraught.

The final "if" is still possible. Perhaps Bitcoin has broken the four year cycle, and even if it hasn't, HIVE might not suffer as much as some more speculative alt coins if the bear market kicks in next year - "might not" being the key phrase, because for all I know, it might!

However, what I can say is that the Buffett Indicators suggest that we should be a little more fearful than we might want to be at this stage...

I'm not suggesting that you go and sell your Bitcoin while it's over $115,000 because I'd prefer to hold for the l-o-n-g t-e-r-m come what may. Come what may in 2026, I am definitely long-term bullish!

More specifically, in the short term, since I have recently borrowed against my Bitcoin to chuck $1,000 into HBD, I think the prudent thing for me would be to make sure that I reduce my exposure to some degree. I think that it would be better NOT to borrow against Bitcoin when Bitcoin is racking up new all time highs, and indeed, I borrowed when Bitcoin was at $107,000 so I have built up quite a nice cushion with the recent surge in valuation, with only 50% of my BTC collateral tied up in the loan, and some of the loan paid off already.

https://hive.blog/hive-125568/@hirohurl/using-bitcoin-to-borrow-usdt

I am happy with this strategy of using Bitcoin to build up my HBD position without selling Bitcoin, but I am not going to get too greedy and increase my risk exposure just to squeeze more cash out of my Bitcoin right now, when so many others are getting greedy and talking as if the only direction for their favourite crypto (e.g. Hive's 2nd tier $LEO token right now...) is UP! LOL!

Conclusion

I think the Buffett Indicators are well worth checking from time to time, especially if you are getting excited by all the froth. Just because "there's only a limited number of Bitcoin" doesn't mean that a bunch of the holders of the said "limited number" can't suddenly panic and dump them on the market!

Yes, I'm a long term bull... and a HIVE token stacker, but I'm not going to max out my credit cards to buy more Bitcoin - especially when the Buffett Indicators suggest the stock market is significantly oversold, and that the sentiment is either "greedy" or "extremely greedy"!

What do you think? Are you bullish or bearish and why? Let me know in the comments!

Cheers!

David Hurley

#InspiredFocus