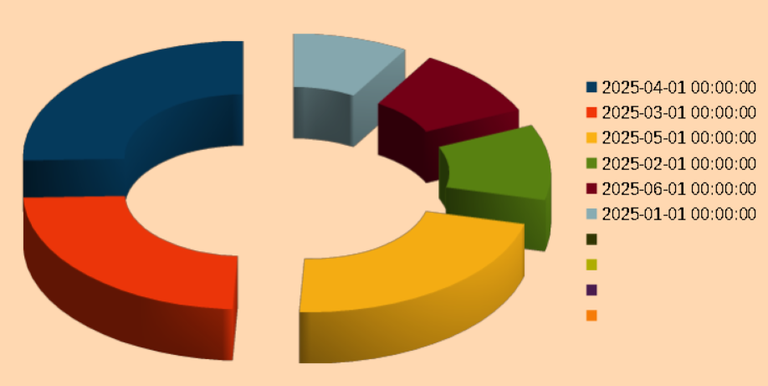

January–February 2025: Foundation and Initial Expansion

The portfolio began the year with moderate exposure across a diverse set of assets, with $LTC holding the largest allocation (~3,698 in January, rising to ~5,867 in February). Strong positions were also maintained in BBHO, LGN, and BRO, complemented by emerging holdings like ALIVE, LOH, and SWAP.GIFU. February saw incremental growth across most assets, with notable increases in BRO and LEO, signaling an early phase of capital reallocation toward both high-liquidity tokens and mid-cap positions.

March 2025: Broad Diversification and Growth Surge

March marked a substantial increase in $LTC to ~15,700, signaling aggressive deployment toward a primary anchor asset. LEO, BBHO, and BRO also expanded their positions, and INDEX, $POLYGON, and $ETH gained traction as secondary diversification plays. The month featured a balanced strategy—maintaining strong core holdings while gradually scaling newer positions such as SWAP.GIFU and LGN.

April 2025: Consolidation with Selective Scaling

In April, $LTC rose to ~16,293, maintaining dominance in the portfolio. BRO, LEO, and DEC strengthened, while DAB more than doubled from March’s level. $POLYGON and $ETH saw substantial increases, reflecting a shift toward higher exposure in network-native assets. The portfolio also maintained stability in BBHO and INDEX, suggesting a consolidation phase while selectively scaling assets with growth momentum.

May–June 2025: Capital Rotation and Position Realignment

May saw $LTC peaking at ~12,194 before sharply contracting to ~4,987 in June, indicating significant capital rotation. High allocations in BRO and DAB in May were reduced in June, while SPS, INDEX, and LOH emerged as notable allocations in the final month. SWAP.HBD and $POLYGON maintained relevance despite position trimming. By June, the portfolio showed a leaner, more concentrated allocation mix, possibly in preparation for new deployments or risk reduction.