Got back into morning run—no biking adventure yesterday. The trails were dry and inviting, and the early air felt fresh, making it a straightforward yet energizing session.

There’s something grounding about sticking to the familiar pace, especially when days feel scattered. By the time I got home, I already felt mentally sharper.

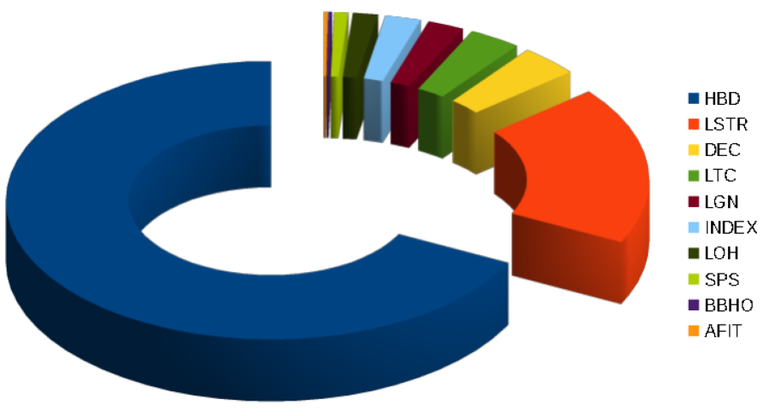

I’ve been executing a few small trades in $HBD throughout the day, as usual—nothing overly aggressive as always, just staying in tune with the market waves. Although momentum seems to be creeping upward, I'm being cautious and haven't pushed trades beyond the $0.262 mark yet.

It's a tight zone, and waiting for clearer signals feels wiser right now. Meanwhile, the price of $HIVE continues to inch upward slowly, bringing mild optimism to the scene. Staying patient in these pullbacks often offers better entry points.

My position as #10 on the $LSTR rich list only held for a day—another user bumped me out, which stings but also pushes me to double down. I’m considering deploying roughly 400 HIVE to climb back into the top bracket.

It may seem like a large move, but with $LSTR community engagement rising, securing a top 10 slot again feels worth it.

Game of inches in staking and influence—sometimes you need to push when positions get tight. I'll calculate carefully, but the upside of solid community recognition may align well with compounding strategy.

Maybe I got more $INDEX liquidate - I hope the buy wall holds till than.