Welcome to 2026. While the calendar flips and the dates change, the market operates on a continuous continuum, entirely oblivious to our human demarcations of time. For the disciplined investor, the arrival of a new year is less about celebration or grand resolutions and more about a renewed commitment to the established process that governs our daily operations.

The discipline that carried us through the past year is the exact same tool required for the year ahead.

View on '25

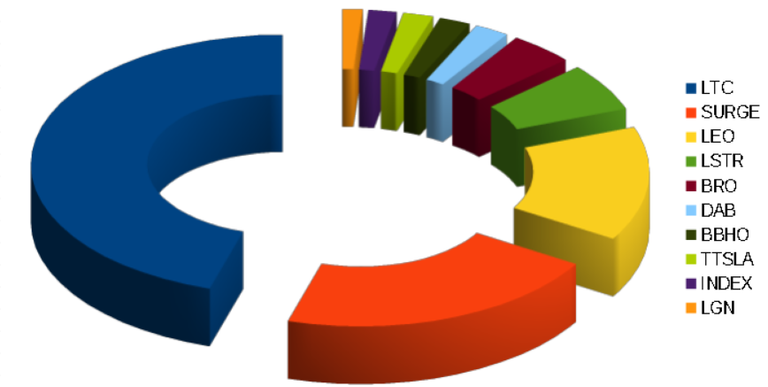

Yesterday’s closure of the 2025 fiscal period confirms a revenue distribution heavily anchored by LTC at 45.32%, functioning as the primary liquidity sink during a volatile year-end transition. This concentration in LTC was a deliberate execution response to a fractured market structure where Bitcoin retraced from its $126,000 peak to stabilize near $88,000, triggering a series of derivatives liquidations totaling approximately $146 million. Performance was further bolstered by high-conviction positions in SURGE (21.02%) and LEO (14.27%).

The start of the 2026 cycle necessitates a total impairment of the positions in $BRO and $LGN, which previously accounted for 4.15% and 1.30% of the 2025 revenue respectively. Following a terminal evaporation of liquidity across primary execution venues, these assets are now classified as worthless for the upcoming reporting period.

The technical post-mortem indicates that while these assets contributed to the 2025 top-line growth, their current zero-value status requires a structural recalibration of the low-cap risk parameters to prevent similar tail-risk exposure in the Q1 2026 pipeline.

Token | Revenue Contribution (%) | Status |

|---|---|---|

LTC | 45.32 | Active |

SURGE | 21.02 | Active |

LEO | 14.27 | Active |

LSTR | 5.99 | Active |

BRO | 4.15 | Worthless |

LGN | 1.30 | Worthless |

Balance start of '26

Establishing the baseline for the new year begins with a cold, objective audit of current inventory to determine our exact exposure. As of this first recording of 2026, the portfolio holds 106.443 units of $SURGE, currently reflecting a valuation of 769.791970 $HIVE. Exposure to $TTSLA stands at 45.853 units, which calculates to a valuation of 1708.627318 $HIVE in base currency terms. The $TGLD position is maintained at a level of 19.454 units with a value of 536.125985 $HIVE, alongside a holding of 68.943 $TNVDA valued at 1060.526175 $HIVE. These figures serve as our initial navigational beacons, defining our starting risk profile and capital allocation as we officially enter the first quarter. This precise tracking is essential for measuring performance not just in nominal token terms, but in the actual purchasing power relative to the ecosystem's base asset.

Asset | Quantity | Valuation ($HIVE) |

|---|---|---|

$SURGE | 106.443 | 769.791970 |

$TTSLA | 45.853 | 1708.627318 |

$TGLD | 19.454 | 536.125985 |

$TNVDA | 68.943 | 1060.526175 |

Moving on with $TNVDA

Based on current market structure and internal valuation models, I am actively initiating an accumulation phase for $TNVDA. Increasing position size here reflects a calculated, long-term bet on the asset's underlying thesis maturing over the medium term. However, acquiring the asset is only the first step in lifecycle management; the next critical decision regarding these new units revolves around capital efficiency. I am utilizing the upcoming weekend as a dedicated period for deliberation regarding the staking of this newly acquired inventory.

This "thinking phase" is crucial to weigh the benefits of potential yield generation against the opportunity cost of locking liquidity in an uncertain market. A final decision to stake will only be made if the risk-adjusted return significantly outperforms maintaining the flexibility of a liquid asset.

1st HPUD '26

Beyond the specific asset movements within the portfolio, today is also Hive Power Up Day, a crucial monthly ritual for anyone serious about the long-term health of their base-layer capital. Powering up $HIVE is a good move that converts liquid tokens into staked influence, effectively committing to the ecosystem's future while increasing your own curation efficiency. By locking these tokens, we prioritize long-term governance and compounding rewards over short-term exit liquidity, which is a hallmark of a disciplined investment strategy.

Starting 2026 with a significant power-up sets a professional tone for the year, signaling a commitment to capital preservation and the steady accumulation of resource credits. This process ensures that we aren't just speculating on price action, but actively building a foundational "stake" that earns a consistent yield through the protocol's inflation and distribution mechanics. It is the ultimate exercise in patience—trading the ability to sell today for a more robust and influential position in the months to come.

Hive's New Year's market

The macro environment for our base currency, $HIVE, displayed characteristic volatility over the New Year's Eve transition period. While a brief rally provided a temporary uplift in total portfolio valuation, price action is currently trending back towards the familiar 9-cent level.

This reversion to previous support zones serves as a reminder that short-term sentiment driven by holidays often gives way to longer-term market structure. For the disciplined trader, this retracement is not a signal for alarm, but rather a data point regarding the actual strength of demand at these lower levels.

One must constantly evaluate our $HIVE-denominated gains against the backdrop of the base asset's fluctuating purchasing power. Navigating this persistent volatility requires patience and a refusal to chase fleeting holiday momentum.