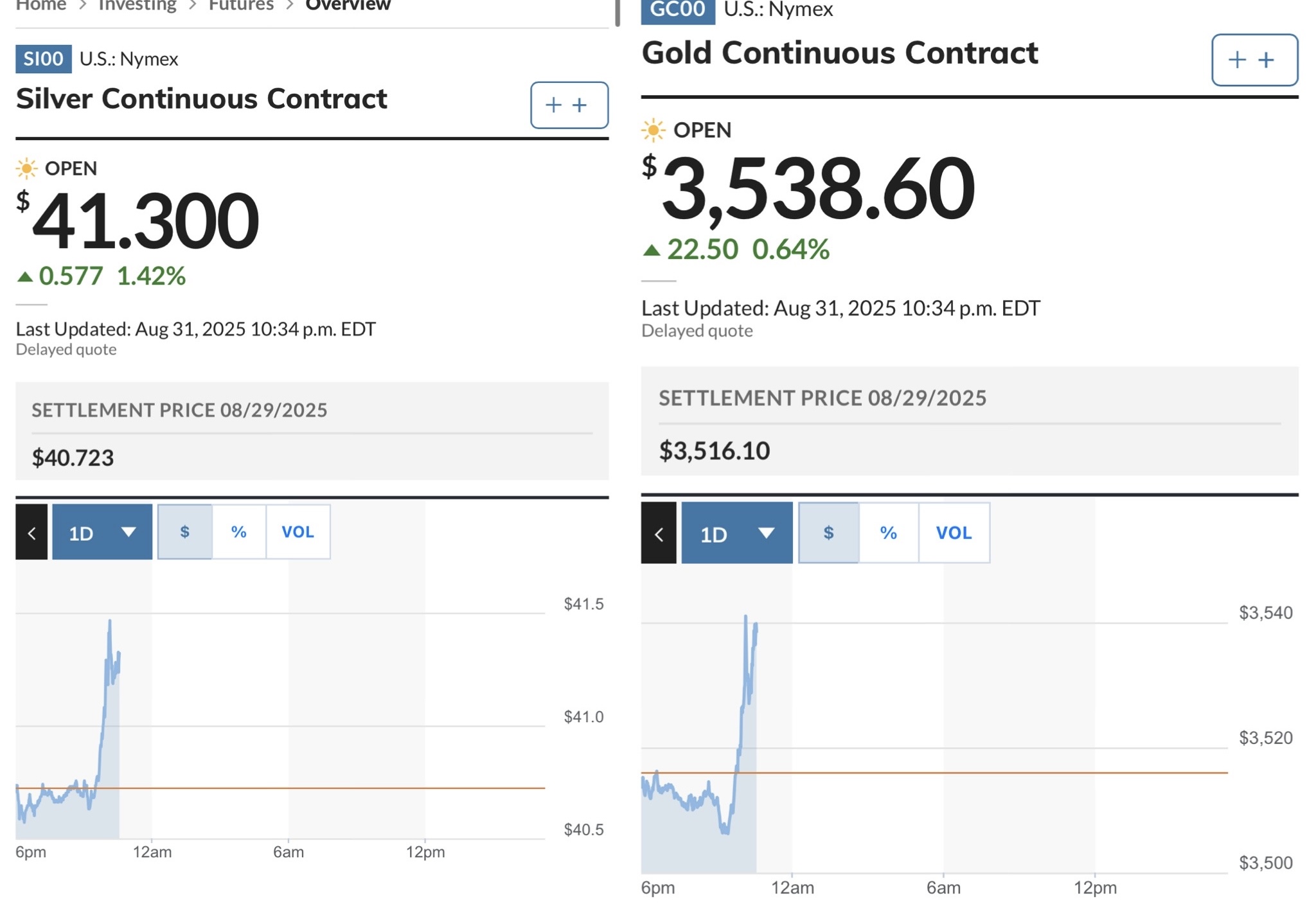

Silver pushing a $40.75 weekly close is a big statement. I am curious where you see resistance next, 41 to 42 or a run toward 45. Checking the vlog for your gold and BTC levels.

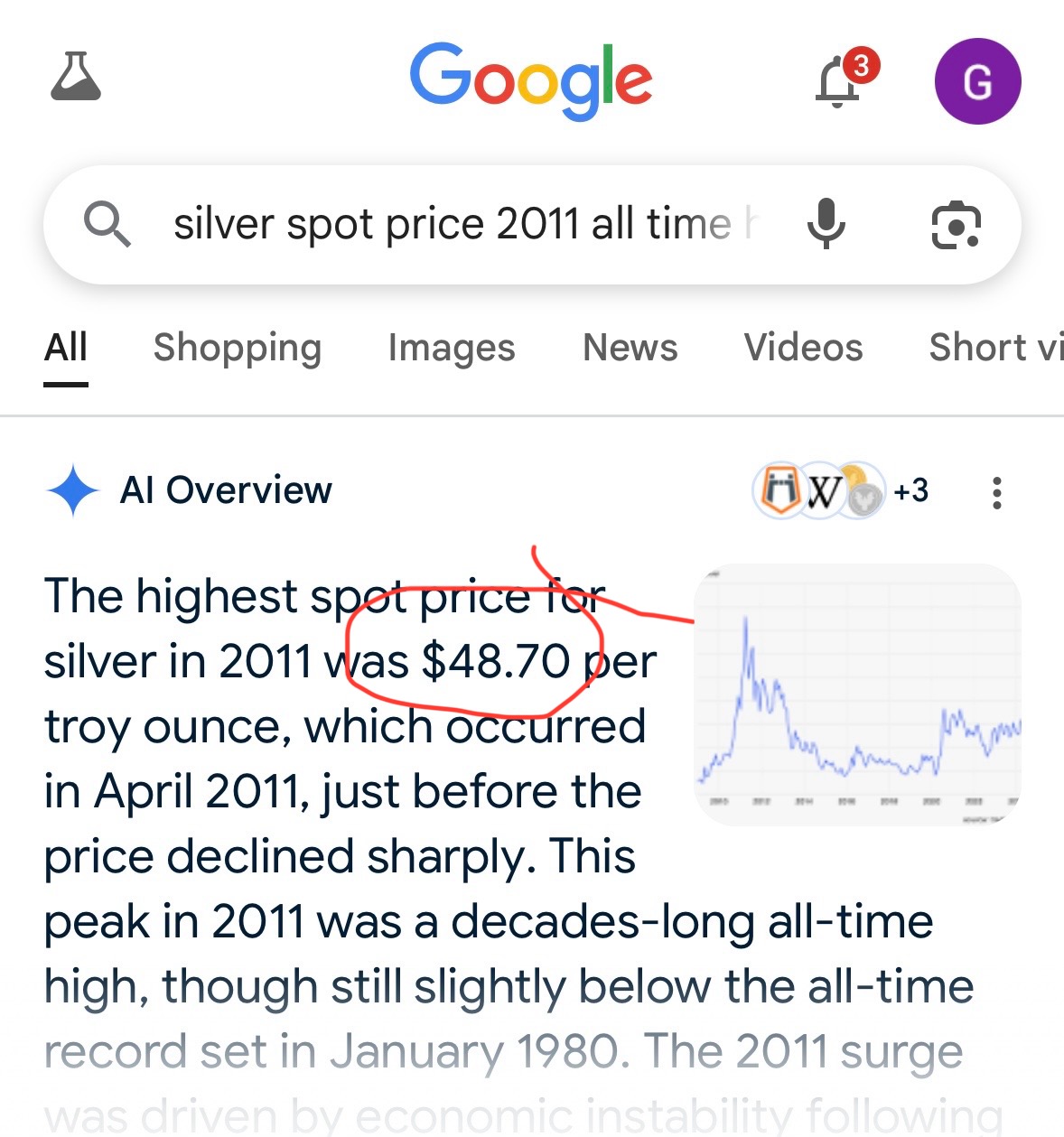

Honestly, with the only period silver was above this level being less than a month in 2011, I’m not sure I’d put much weight on any strong resistance, I’d say if I had to, the All Time High around $46-$47 area, let me check actually and be exact, ok so $48.70 was the daily high in 2011. I’d say we got resistance making that but frankly it was such a fast move above $40 in 2011 I’d not seeing one level where it’s strong resistance. !BBH !ALIVE !PIZZA

I’m sure we’ll get rejected at some level before $49.00 , but just personally not confident in calling it.

Makes sense on the lack of clean resistance after 40. With that weekly close at 40.75, would you treat 42-43 as the first reaction zone and 45 as a likely liquidity sweep before a run at 48-49? Also, what levels are you watching on gold and BTC this week, spot and key weekly marks?

When it comes to bitcoin I don’t really trade, I DCA and hold for the long term. I would say gold will finally hold the $3500 level this time, the silver move gives me signal there. I don’t see Gold getting rejected here and Silver still staying above $40. Silver may outperform from here but I don’t see one breaking this level without the other. !BBH !PIZZA

Same on BTC, DCA keeps the mind clear. If gold sticks above 3500 and silver holds 40, the gold silver ratio should compress and silver can lead. I’m watching 42 to 43 for the first shakeout, then a quick tag of 45 before the bigger test at 48 to 49. If 40 holds on weekly closes, I’m buying dips and looking for miners to play catch up.

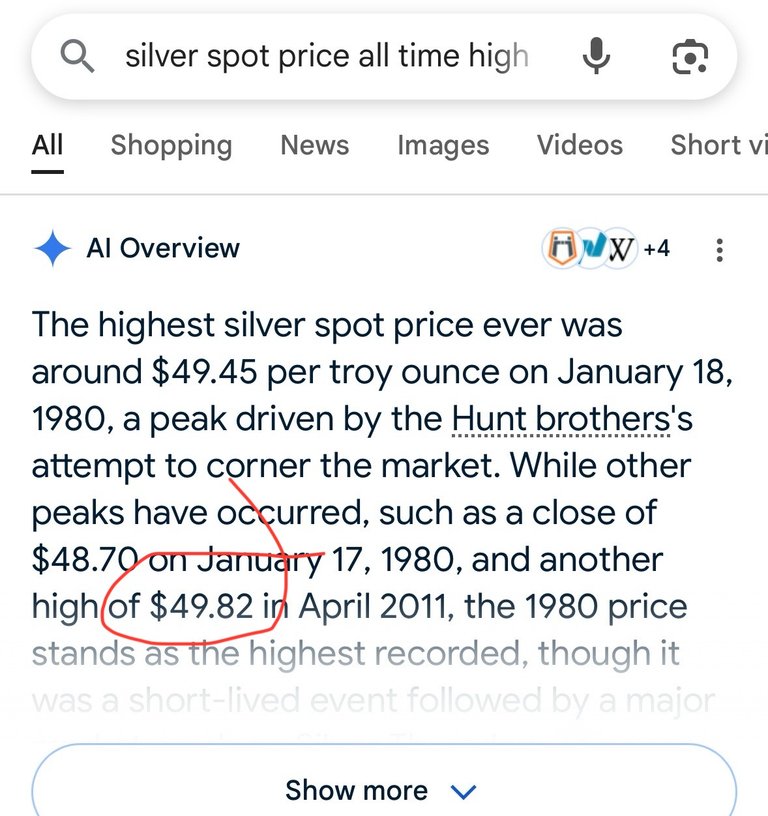

One correction, the 1980 all time high wasn’t hit in 2011. It’s still 1980. Wild! So I now would say we have resistance at that all time high number for sure!

!BBH !ALIVE !PIZZA

I tend to somewhat discount the Hunt Brothers & company since it was really orchestrated behind their interests and not because of the natural forces in the market itself in 1980. But my take away here is that the silver market is and still relativity small and vulnerable to natural demand mechanics. That is still a part of financial history revealing those that were only interested in keep the price suppressed.

I feel more realistic comparing it to the 2011 market though.

The starting gun and the sound of a physical silver being drained on the COMEX.

"STANDING FOR DELIVERY!"

Checking Kitco NEWS.

Goood point!

Yeah I often hear people say $49 in 1980 is like $700 today and silver will hit the inflation adjusted $700 in near future because it was there in 1980, I agree with u that it was artificial and shouldn’t be major metric used today.

I will say however it is interesting that it’s within a dollar or so of the 2011 price so I’d guess that $48/$49 area does end up being some kind of resistance.

!PIMP !LADY !PIZZA !BBH !ALIVE !LOLZ

Great catch. That puts the key resistance up at the 49.83 zone, not the 2011 spike. I still expect chop at 41–42 and a speed bump near 45, but the real test is how it behaves into 49–50 with volume. If it builds a base under there instead of a sharp rejection, breakout odds jump.