I tend to somewhat discount the Hunt Brothers & company since it was really orchestrated behind their interests and not because of the natural forces in the market itself in 1980. But my take away here is that the silver market is and still relativity small and vulnerable to natural demand mechanics. That is still a part of financial history revealing those that were only interested in keep the price suppressed.

I feel more realistic comparing it to the 2011 market though.

You are viewing a single comment's thread from:

Sort: Trending

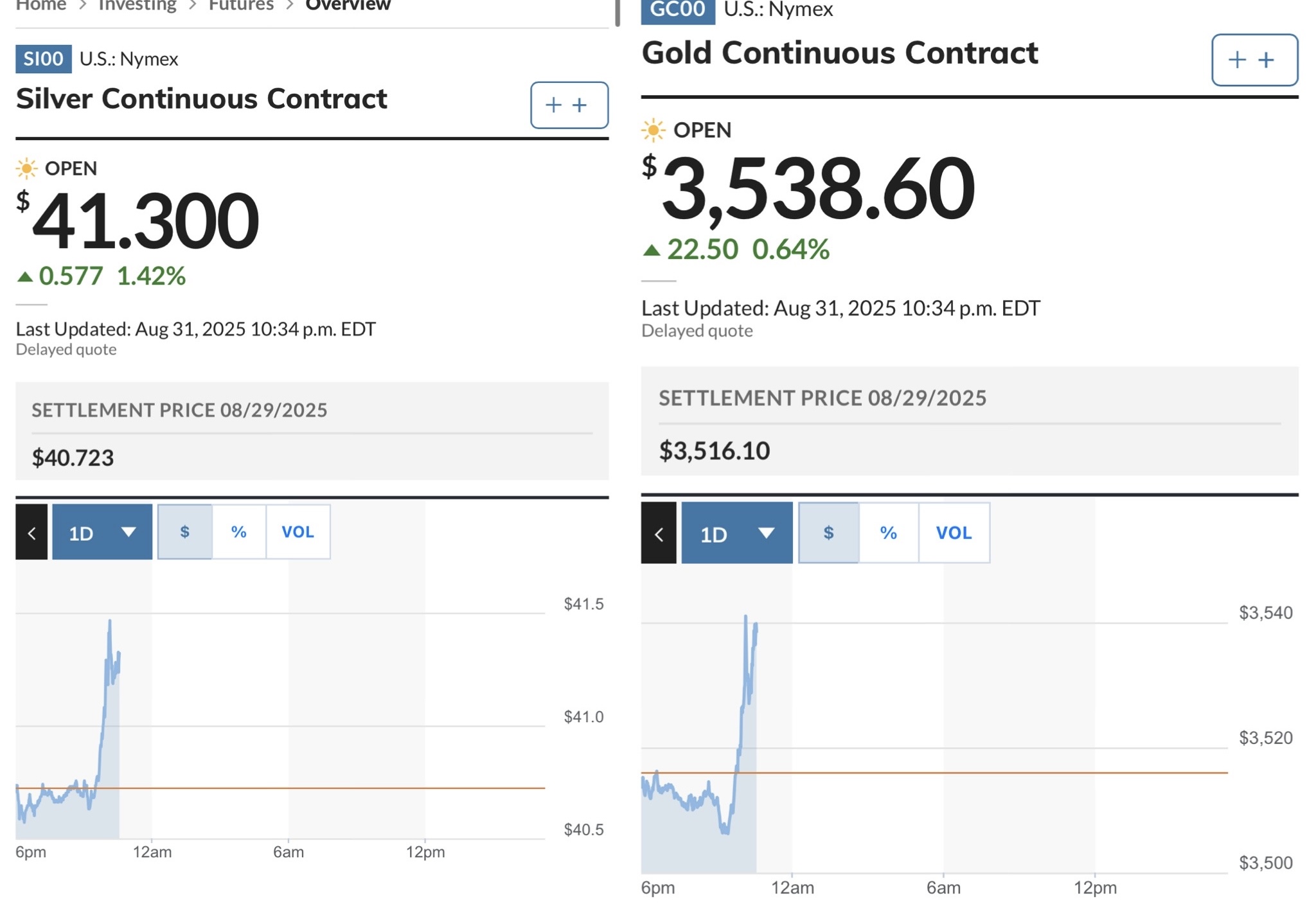

The starting gun and the sound of a physical silver being drained on the COMEX.

"STANDING FOR DELIVERY!"

Checking Kitco NEWS.

Goood point!

Yeah I often hear people say $49 in 1980 is like $700 today and silver will hit the inflation adjusted $700 in near future because it was there in 1980, I agree with u that it was artificial and shouldn’t be major metric used today.

I will say however it is interesting that it’s within a dollar or so of the 2011 price so I’d guess that $48/$49 area does end up being some kind of resistance.

!PIMP !LADY !PIZZA !BBH !ALIVE !LOLZ