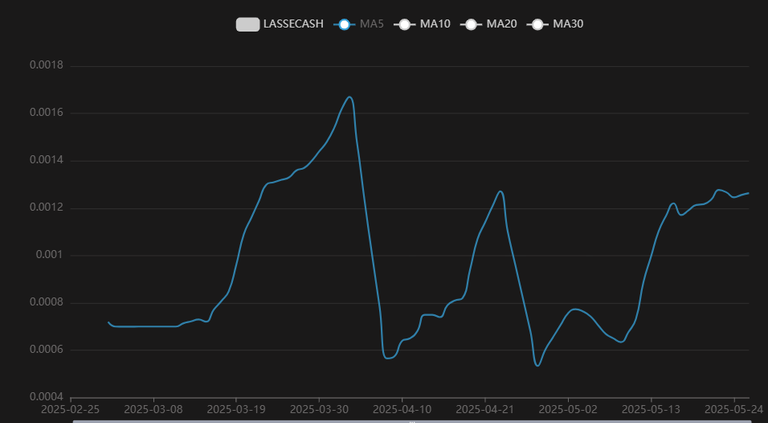

As I've been on and off the blockchain, I occasionally go back to some of my favorite tokens. Among my favorites is LASSECASH, the underdog of tokens. While many tokens get dumped and flatline, Lassecash has been vibrant, maintaining a solid HIVE value. Several prime buying opportunities.

Why stack LASSECASH? It's not complicated: it's ROI.

It's the LASSECASH:SWAP.HIVE Liquidity pool.

A Pool that Rewards DAILY LASSECASH

I always give the disclaimer that I'm not offering investment advice, but explaining investment opportunities.

If you're not familiar with how liquidity pools work, it's basically when a user supplied "liquidity", that is certain tokens, to create a "pool" of tokens that can be swapped back and forth.

https://www.lassecash.com/pool/add

https://tribaldex.com/pools

https://beeswap.dcity.io/pools?search=lasse

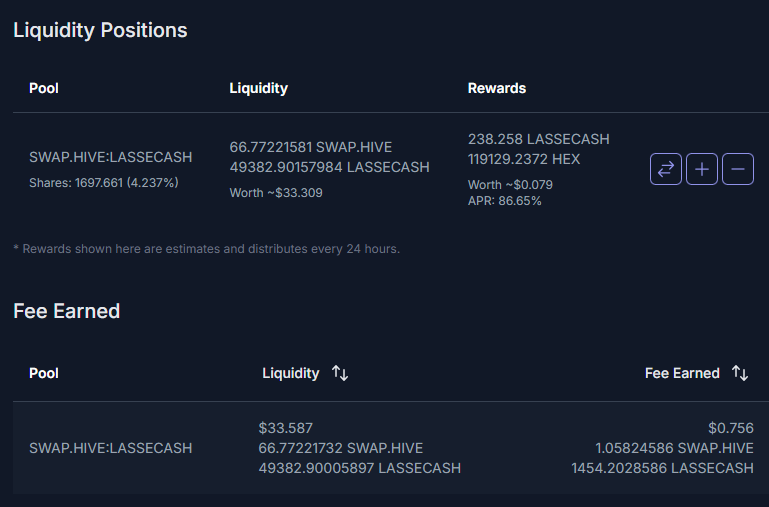

In this example, the user has supplied about 49K LASSECASH and about 66 SWAP.HIVE tokens.

Earning From Fees

Everytime someone uses the pool to swap between SWAP.HIVE and LASSECASH, the swapper pays a small fee.

By contributing to the pool, the investor earns a SHARE of the fees and they are rewarded according to their share. The more contributed, the higher the share and the larger their payments!

These small fees add up over time, this user has earned about $0.75 worth of SWAP.HIVE and LASSECASH, just for contributing to the pool.

But The Big Incentive is REWARDS

In addition to fees, some pools have added incentives to encourage people to invest in the pool: REWARDS. Rewards are payed DAILY (!!) based on number of shares the investor has put into the pool. Liquid rewards.

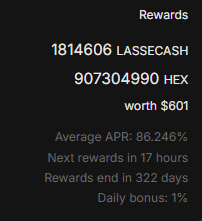

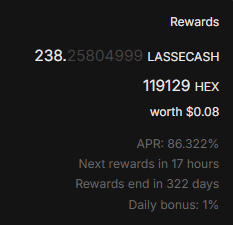

The Lassecash pool pays out a total of 1.8 MILLION Lassecash (and 900M HEX) daily over 322 days. That's over $600 in rewards. Our example user earns 4.2% of that daily, resulting in their $33 investment returns about $0.08/day in rewards.

That's over 86% APR.

Earning over 200/day Lassecash for doing nothing is an amazing investment. Those tokens can be used in anyway they see fit.

86% APR Too good to be true, what's the catch?

No catch. Your shares are your shares. Your rewards are your rewards. However...

Every investment has it's risks and this is no different. The value ratio between SWAP.HIVE and LASSECASH can fluxuate. So the QUANTITY you invest can rise or fall, based on market conditions. It's alway balanced out on the other side.

Say LASSECASH drops in value, that means that people are draining the pool of SWAP.HIVE and your quantity decreases, while your quantity of LASSECASH increases.

Say SWAP.HIVE drops in value and LASSECASH increases in value, that means people will likely be investing more SWAP.HIVE into the pool. Your quantity of Lassecash will decrease, but your SWAP.HIVE will increase.

But if the investor focuses on # of SHARES and keeps the investment intact during market changes, there is no loss to the investor unless they remove SHARES from the pool.

It's not a "CATCH", it's normal crypto investing - when market conditions are good, investments grow. When market contitions are bad, investments shrink.

Most recognize that the REWARDS outweigh the RISK by far. But of course this is just my opinion. Do your own research, not financial advice, bla bla bla.

An Unsung Hero Among Tokens

Lassecash has really been a quiet but steady token. Consistant and realatively stable. Revisiting this token and looking at the liquidity pool again reminds me of the opportunities that this token presents.

I hope this overview has been helpful in making good finanncial decisions, either to avoid or to invest. Whatever you decide.

But most of all, I want to bring AWARENESS.

Posted using LasseCash