The media called for recessions and market plunges, but 2025 is shaping up to be a banger year for me after all.

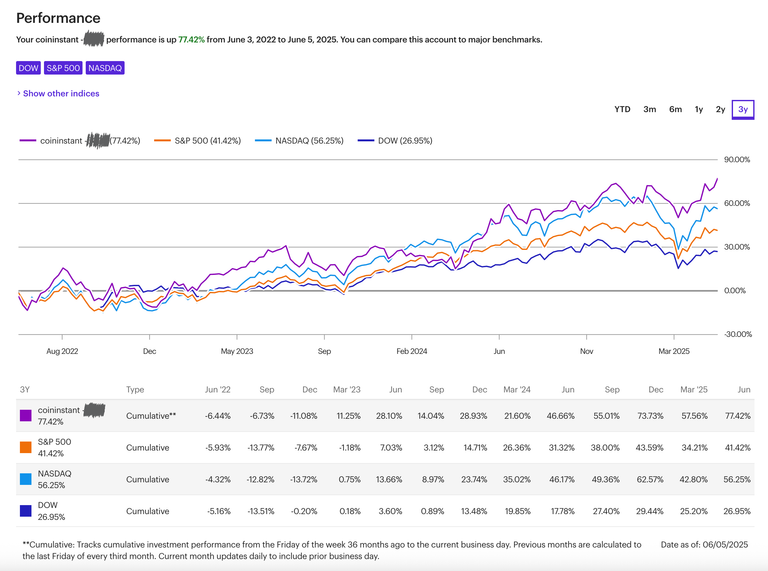

Another year of beating the markets—and this time, I dipped way less than the rest too!

Another year of beating the markets—and this time, I dipped way less than the rest too!

This year’s strategy? Leverage the chaos.

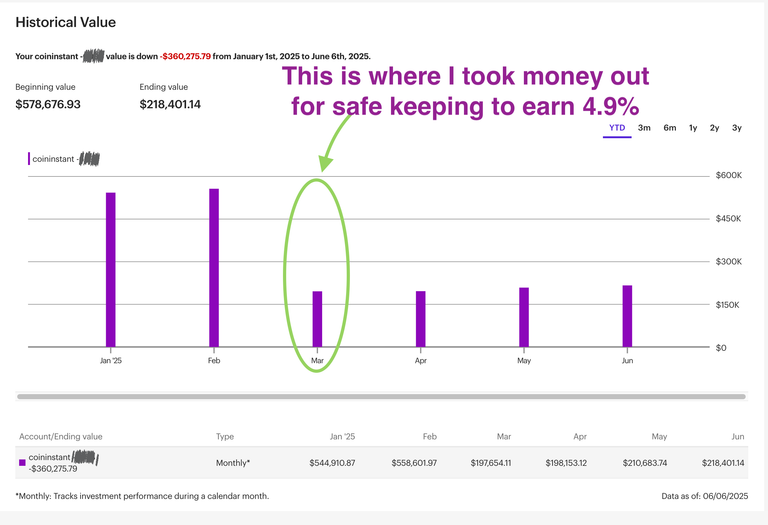

I booked huge gains, stacked cash into savings, and dipped my toe back into short-term trading—volatility and all.

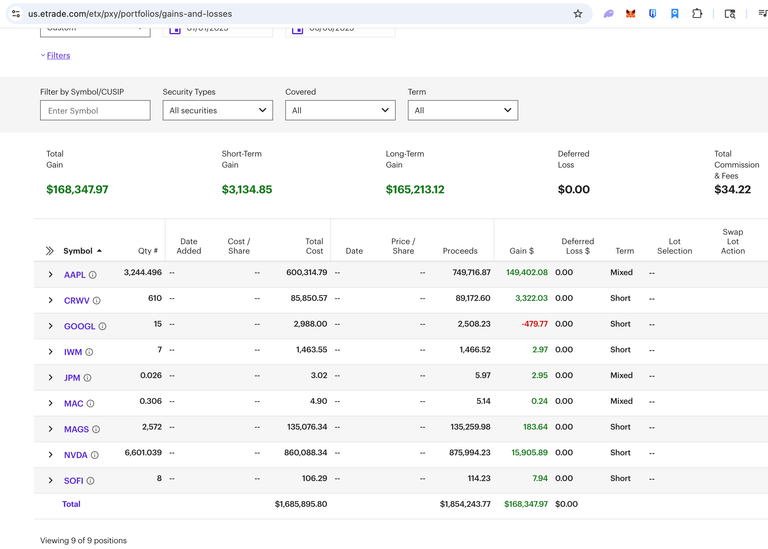

Shifting Gears: Out of Apple, Into AI

I phased out of Apple to double down on where the real momentum is: AI. And so far? It’s paying off.

Locked in Apple gains, secured the bag.

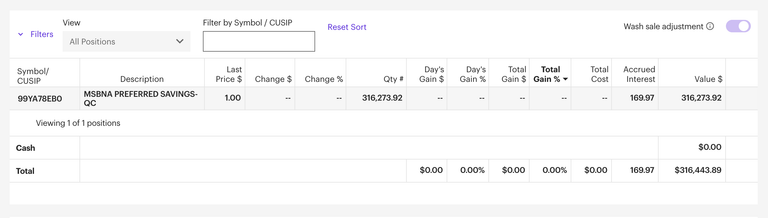

I took >$300K off the table and parked it safely. Now, the plan is simple: grow that cushion while riding the AI wave.

All I need? Get that purple line (above) climbing again. Easy peasy… so far, so good.

All I need? Get that purple line (above) climbing again. Easy peasy… so far, so good.

Right now, I’m earning just under 5% on my emergency fund. It’s not flashy, but it’s safe—freeing me up to take calculated risks without sweating the downside.

But why not stake HBD for 15%?

Simple: If I don’t fully understand it, I don’t touch it. Warren Buffett’s rule #1 applies—no exceptions.

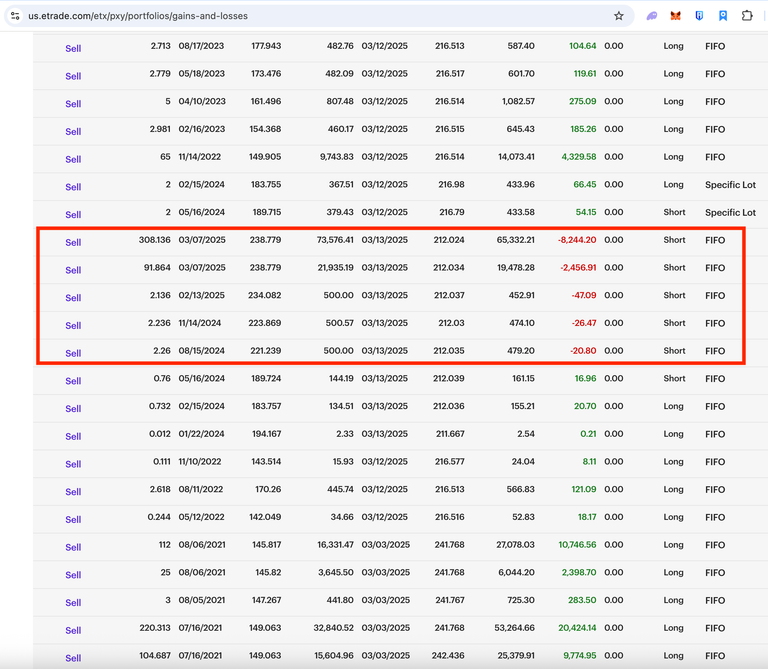

The Not-So-Pretty Side:- "It's not all roses" A Deep Dive into PnLs!

Let’s keep it real—losses happen. I’m far from perfect, but every red trade is a thorny lesson.

Good or bad? For me, these are wins in disguise..

Good or bad? For me, these are wins in disguise..

At first glance, the red hurts. But these losses taught me to cut sooner, hold smarter, and detach emotion from exits. In the grand scheme? A blip on the radar—and a step toward sharper trading.

Conclusion: The Good, the Bad, and the Bigly

2025 is proving that even in a "doom-and-gloom" narrative, opportunities hide in plain sight. I took profits, embraced AI’s rise, and learned from every misstep. The best part? The game’s still on.

Here’s to more greens, fewer regrets, and staying ahead of the curve—no matter what the headlines say.