Welcome back to Day 3 of my 💰 Hive Blockchain Investment Experiment, where I’m comparing two approaches:

🐝 Savings Strategy – Convert Hive into Hive Power (for curation rewards) and hold HBD in savings (earning interest). The steady, passive route.

⚡ Trading Strategy – Actively trade Hive and HBD to capture short-term moves. The fast-paced, flexible route.

The goal: find out which strategy wins over time—steady growth or active flexibility

📈 Today’s Market Prices

🐝 HIVE: $0.2254

💵 HBD: $1.008 (above peg)

💼 Portfolio Snapshot

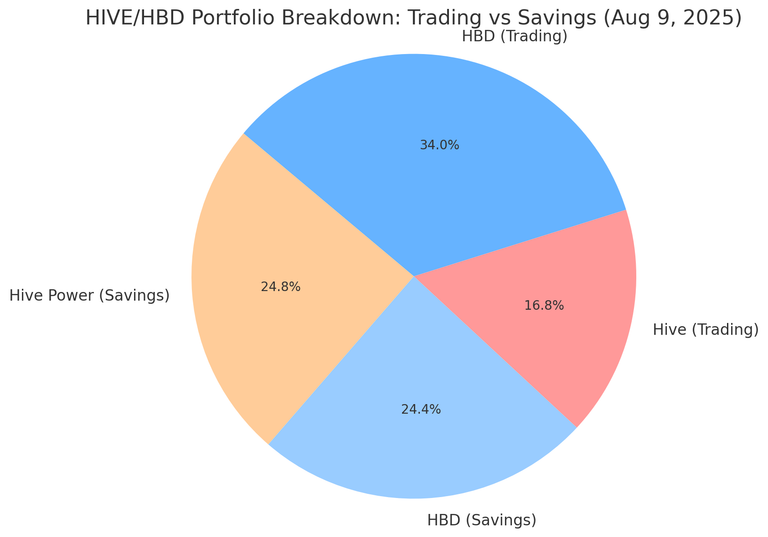

📌 Type 📊 Amount 💲 USD Value

🐝 Hive Power 581.018 $130.96

💰 HBD Savings 128.298 $129.32

📈 Hive (Trading) 393.143 $88.65

💹 HBD (Trading) 178.686 $179.81

Totals:

💵 Savings Total: $260.28

⚡ Trading Total: $268.46

🏆 Lead: Trading ahead by +$8.18

🔍 Analysis & Observations

📊 Trading strategy pulls ahead with its biggest lead yet.

💵 HBD above peg boosts trading side’s USD value.

📈 Hive price rise benefited recent buy orders.

⚡ Compounding faster in trading—profits are reinvested immediately.

⚖️ Risk vs Reward

🐝 Savings Strategy

✅ Predictable returns

💤 No constant management

📈 Passive growth via curation & interest

⚡ Trading Strategy

🚀 Captures quick price swings

🔄 Flexible in market moves

⚠️ Higher volatility risk

📅 What’s Next

Keep an eye on HBD peg stability 🪙

Watch Hive volatility for trade setups 📉📈

Track curation reward growth over time 📊

🏁 Final Thoughts

On Day 3, Trading is up by $8.18 🏆

The race is heating up — this isn’t just about who wins, but which approach proves more resilient over time.