Yesterday was one of those days where I ended up skipping both sports and blogging entirely. Sometimes it’s needed, but it always leaves a strange gap in the rhythm of the day. I didn’t feel particularly productive, and the lack of movement definitely made my energy dip by evening. It have been Saturday after all

Next week is shaping up to be rough, especially with the escalation of global tensions. Reports indicate that Iran was bombed, and in response, there's talk of them potentially blocking sea routes, which could disrupt nearly 20% of the world’s oil supply.

That kind of move could send major ripples through both energy markets and broader economies. It's a stark reminder of how interconnected everything is—from geopolitics to our daily trades. Staying informed and cautious will be key in the coming days.

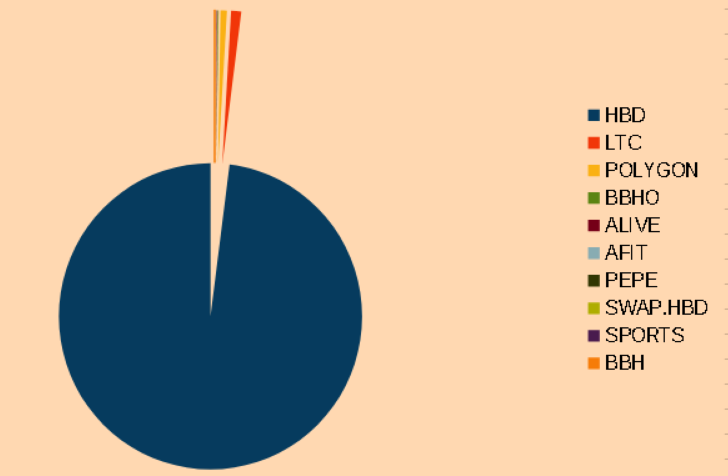

Prices are already reacting to the geopolitical uncertainty, and it seems like the downtrend is tied directly to the news flow. I’ve found myself slightly locked in with my current positions—not the worst timing, but not ideal either. Still, markets tend to overreact in moments like these, so there’s a chance to recover if I play it smart. If reactions turn even more extreme, I might get the volatility I need to make up some ground. It’s a waiting game now—balancing patience and timing.